- CFDs & Forex Trading | Regulated Online Trading

- About Us

- Trading

- Platforms

- Resources

- Partners

- Research

Search

×

Find out how much profit or loss in money and pips for your trading position using real live market data, trade direction and the number of lots traded

Easily calculate your potential profits and losses with this accurate profit calculator.

It’s important that you’re prepared for every possible outcome to help manage your trade risk more effectively.

Forex Calculators

A Forex Profit Calculator is extremely helpful to find out how much money and pips a trading position represents when a position is closed in profit or loss. It works by simulating a trade position by taking the difference of open and close price values specified, and show the results of potential profit or loss in money and in pips.

Professional traders always have a plan before entering a trade. Whether you’re using a stop loss or take profit or closing the trade manually, it’s important to understand your potential profit or loss to plan ahead for any outcome. This tool is suitable for investors with any level of experience.

STEP 1

Select Instrument: Here you can choose from various financial instruments including major, minor and exotic currency pairs, popular stock indices, top cryptocurrencies like BTC, ETH, DOGE, LTC and XRP, and commodities such as Gold, Oil and Silver.

For our example, we’ll select EUR/USD.

STEP 2

Select Deposit currency: Choose your trading account deposit currency to properly calculate for that currency in your results.

We will select USD for our deposit currency (account currency) for our example.

STEP 3

Select Buy or sell: Here you can choose the trade direction you plan on entering the market, either long (buy) or short (sell).

For this example, we will select a buy trade to simulate our trade position.

STEP 4

Select Lots (trade size): Keep in mind in forex trading, one standard lot is 100,000 currency units, however units per 1 lot can vary for non-forex currency pairs. There’s also an option to switch between lots or units for the calculation.

In our example, we will choose our trade size as 0.15 lot.

STEP 5

Type Open price: Here you will type in an open price for your trade.

We will input an open price of 1.08496 for our EUR/USD trade.

STEP 6

Type Close price: Lastly, type in the close price for your trade.

In our example, we will type a close price of 1.10496. Next click the “Calculate” button.

STEP 7

Results: The profit calculator will quickly calculate the trade profit in money (converted in your selected base currency) and profit total in the amount of pips gained.

Thus, for our example, opening a buy EUR/USD trade of 0.15 lots at 1.08496, and close it at the close price of 1.10496, will result in a profit of US$300.00 (profit in money), with a total of 200 pips gain (profit in pips).

When you start trading foreign exchange (forex) and CFDs (contract for difference), you can trade on both sides of markets’ rising and falling price quotes. If you see rising prices, you could buy (also called going “long”); if you see falling prices, you could sell (also referred to as going “short”).

For example, if you see the Euro rising against the U.S. dollar, you could go long on EUR/USD; if you see the Euro falling against the U.S. dollar, you could go short on EUR/USD.

Refers to the traded value of a contract on the Forex or CFD market. This is calculated as a standard lot size multiplied by the lot amount. Keep in mind the Forex standard lot size represents 100,000 units of the base currency. For CFDs and other non-forex pairs, view the contact specification details in the trading platform.

For example, using our profit calculator, 100 units of gold or XAU/USD (standard lot of gold) equals 100 ounces. If we buy 100 units at 1926.00 and sell at price 1927.00, you would profit US$100.00.

This is also referred to as “symbol”. The trading asset which you can Buy (long) or Sell (short) for financial gain.

The ratio of position’s notional value to the amount of margin required for opening a trade. For example, if you have a leverage of 1:400 and trade one standard lot on EUR/USD, that means a EUR 100,000 contract requires 250 EUR margin needed to open the trade.

This is a volume term in Forex trading, traders often refer to the number of “lots” and typically a number of “contracts” with non-forex CFD pairs.

• 1.00 volume means 1 standard lot or 100,000 base currency units.

• 0.10 volume means 1 mini lot or 10,000 base currency units.

• 0.01 volume means 1 micro lot or 1,000 base currency units.

This is the amount of money (margin) you need to open and maintain your trading position.

“Pip” stands for percentage in points and is the most common increment of currency prices when trading forex. In the forex market, currencies quoted to the 5th decimal place (for example, EUR/USD at 1.08426), 1 pip is equivalent to a price increment of 0.00010; other currency pairs quoted to the 3rd place following the decimal place (for example, USD/JPY at 129.660) 1 pip is equal to a price increment of 0.010. For stock indices, 1 pip is equal to price increment of 1.0 (also referred to as index point).

Your profit or loss (shown with a minus sign -) for a trading scenario that you calculated.

The smallest change in price of an instrument. For example, 0.00001 for GBP/USD rolling Forex and 0.1 points for US30 index CFD.

Easily and accurately calculate the recommended lot size by using live market data in real-time, account equity, risk percentage and stop loss.

Find out how much account equity will be used to open a trade position, based on the lot size and trading account leverage with live market rates.

Easily calculate pip value based on live market data, account base currency, lot size and traded pair into figures that are extremely useful for any Forex trader.

Cryptocurrency & Currency Converter

Quickly convert and see the latest exchange rate of any major currency pair or cryptocurrency pair within seconds.

ZERO Deposit Fees

Choose from multiple (15+) deposit options such as Skrill, Neteller, Visa/Mastercard, Crypto, Local Bank and others with zero fees.

Global Market Access

Trade CFD's (1000+) on a wide range of instruments including Forex, Shares, Commodities, Indices, Precious Metals, Cryptocurrency and Energy.

6 Ways to Trade

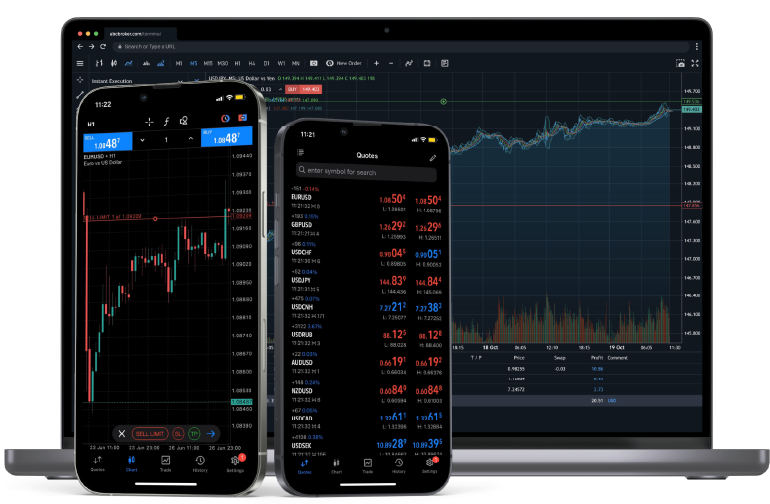

Trade when you want and anywhere at your convenience with Windows OS, MacOS, iOS, Android, WebTrader and even Linux.

Sub 30ms Latency Trading

Trades are executed through liquidity engines in LD4 and access servers in Asia, Europe and Africa.

Supports Proprietary Trading

Get access up to $2 million in funded trading for qualified profitable traders on MT5.

24/5 Unparalleled Service

Knowledgable and prompt service available on Live Chat, Email, Phone, Whatsapp and Telegram.

Choose from multiple trading options based on your preference of order types, indicators, charting tools, style of trading and operating environment.

Beginner or Advanced? View our full suite of tools and resources to help traders of all levels.

Get started quickly with our free forex trading course for beginners to level up on your trading knowledge.

Evaluate your risk, monitor profit or loss for each trade & estimate trading costs with our full suite of calculators.

Follow high impact news and events for the financial markets including the latest economic data.

Stay up to date with the latest fundamental and technical analysis from the Baxia Markets Analyst team.

Find answers to common questions and topics related to trading with Baxia Markets and the trading platforms.

View our collection of free educational resources to help you become a profitable trader and learn risk management.

More than 1000 CFD instruments to trade on multiple asset classes with one broker.

Forex

Precious Metals

Crypto CFDs

Energy

Indices

Commodities

Shares

BAXIA GLOBAL LIMITED

Join the community

Risk Warning: Margin trading involves a high level of risk, and may not be suitable for all investors. You should carefully consider your objectives, financial situation, needs and level of experience before entering into any margined transactions with Baxia Markets, and seek independent advice if necessary. Forex and CFDs are highly leveraged products which mean both gains and losses are magnified. You should only trade in these products if you fully understand the risks involved and can afford losses without adversely affecting your lifestyle (including the risk of losing the entirety of your initial investment). You must assess and consider them carefully before making any decision about using our products or services.

Baxia Global Limited is a company registered in Seychelles with registration number: 8426970-1, and is regulated by the Financial Services Authority of Seychelles with License number: SD104.

Baxia Limited is a company registered in The Bahamas with registration number: 177330 B, and is licensed and regulated by The Securities Commission of The Bahamas (SCB), (SIA-F234).

The information on this website is general in nature and doesn’t take into account your personal objectives, financial circumstances, or needs. It is not targeted at the general public of any specific country and is not intended for distribution to residents in any jurisdiction where that distribution would be unlawful or contravene regulatory requirements. Baxia Markets does not offer its services to residents of certain jurisdictions such as USA, Cuba, Sudan/Republic of Sudan, Syria, Iran, Iraq, South Sudan, Venezuela, Libya, Belarus, Afghanistan, Myanmar, Russia, Crimea, Donetsk, Luhansk, Palestine, Yemen, Zimbabwe and North Korea.