- CFDs & Forex Trading | Regulated Online Trading

- About Us

- Trading

- Platforms

- Resources

- Partners

- Research

Search

×

CRYPTO HUB

Trade the world’s most sought-after asset class, cryptocurrency CFDs, including Bitcoin, Ethereum & Litecoin. Below is our pricing or scroll down further to learn more about cryptocurrency CFD trading.

Important:

1. Positions that are held open for the next trading day (past 00:00 server time) will incur swap charges. The swap charges are calculated on the basis of interest rates difference of two currencies in the instrument. In the MT5 terminal, “swap” is automatically converted into the deposit currency of the account. Swaps values may be adjusted daily based on market conditions. For the latest swap values, please check the specifications in the MT5 terminal.

2. Clients are advised that during the time period from 23:55 to 00:05 server time, spreads may increase and liquidity might decrease due to daily bank rollover. In case of inadequate liquidity and wider than normal spreads, slippage may occur. In addition orders may not be executable during these times.

ZERO Deposit Fees

Choose from multiple (15+) deposit options such as Skrill, Neteller, Visa/Mastercard, Crypto, Local Bank and others with zero fees.

Global Market Access

Trade CFD's (1000+) on a wide range of instruments including Forex, Shares, Commodities, Indices, Precious Metals, Cryptocurrency and Energy.

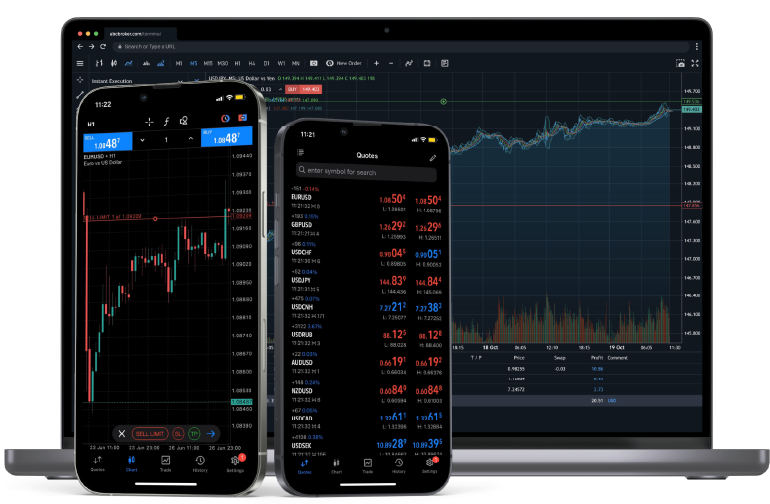

6 Ways to Trade

Trade when you want and anywhere at your convenience with Windows OS, MacOS, iOS, Android, WebTrader and even Linux.

Sub 30ms Latency Trading

Trades are executed through liquidity engines in LD4 and access servers in Asia, Europe and Africa.

Supports Proprietary Trading

Get access up to $2 million in funded trading for qualified profitable traders on MT5.

24/5 Unparalleled Service

Knowledgable and prompt service available on Live Chat, Email, Phone, Whatsapp and Telegram.

Choose from multiple trading options based on your preference of order types, indicators, charting tools, style of trading and operating environment.

Beginner or Advanced? View our full suite of tools and resources to help traders of all levels.

Get started quickly with our free forex trading course for beginners to level up on your trading knowledge.

Evaluate your risk, monitor profit or loss for each trade & estimate trading costs with our full suite of calculators.

Follow high impact news and events for the financial markets including the latest economic data.

Stay up to date with the latest fundamental and technical analysis from the Baxia Markets Analyst team.

Find answers to common questions and topics related to trading with Baxia Markets and the trading platforms.

View our collection of free educational resources to help you become a profitable trader and learn risk management.

Cryptocurrency trading involves buying or selling digital currencies with the intention of profiting from the fluctuation in the value of the underlying asset.

Crypto trading differs from directly investing in a cryptocurrency. For instance, when you directly invest funds into a cryptocurrency, you can only profit if the selling price exceeds the purchase price.

Crypto CFD trading involves predicting the price fluctuations of cryptocurrencies without holding the actual underlying asset. Here, traders enter a contract with a broker to settle the price difference of the cryptocurrency from the moment they open and close the trade. This allows traders to earn solely from cryptocurrency price changes, eliminating concerns tied to direct asset ownership like security, storage, and accessibility.

Take advantage of crypto volatility anytime

A trading partner you can trust with low-costs

No digital wallet

Avoid complexities of a digital wallet, trade cryptocurrency directly from the same MT5 platform you use for trading

All trading strategies & styles allowed

To ensure you have the flexibility to trade the way you want, we allow the use of EAs & algorithmic trading strategies

Zero commission

When you trade cryptocurrencies with Baxia, you don’t need to pay any additional commission costs on any transaction*

Competitive cryptocurrency spreads

Combined with zero commission, our low spreads make it more affordable to trade top global cryptocurrencies

Leveraged crypto trading

Make your capital go further when you use up to 200:1 leverage on your cryptocurrency trades with Baxia

Trade Cryptocurrency CFDs 24/7

Trade the most popular cryptos: Bitcoin, Bitcoin Cash, Ethereum, Litecoin & Ripple as needed, anytime no matter where you are

| CFDS | OWNING CRYPTO | |

|---|---|---|

| Profits from rising cryptocurrency prices | ||

| Profits from falling crypto prices (go short or sell) | ||

| Trade on margin | ||

| Trade on volatility - you don't need to own the asset or have an exchange account | ||

| No exchange fees or complicated digital wallets | ||

| Manage your risk effectively using a variety of in-platform tools |

Venturing into cryptocurrency trading may appear overwhelming at first, but by dividing it into manageable steps, it can actually be straightforward. Here’s a guide to walk you through the process:

Open and Fund a Trading Account:

Begin your trading adventure by establishing an account with Baxia Markets, a trustworthy broker, offering cryptocurrency CFDs. After setting up your account, it's time to deposit funds. Baxia Markets provides a range of deposit methods based on local regulations, including options like bank transfers, credit cards, etc.

Choose a Cryptocurrency to Trade:

Select a Cryptocurrency for Trading: Then, determine the cryptocurrency you wish to trade. You could lean towards Bitcoin or Ethereum, which are among the most frequently traded digital currencies, or you might consider a lesser-known altcoin. Base your decision on thorough market analysis and your individual trading objectives.

Analyze the Market:

Before opening a trade, it's essential to analyze the market. Fundamental analysis can be used, which assesses the general health of the cryptocurrency's network, news events & market trends. Alternatively, technical analysis focuses on analyzing price charts to understand patterns and trajectories. A combination of both methods is commonly used by professional traders.

Determine Your Move and Open a Trade:

After analyzing the market and deciding on your trading strategy, you can place your trade. Determine if you anticipate the cryptocurrency's value to rise (buy) or decline (sell), and then proceed with your trade. Remember that when trading CFDs, there's potential to gain regardless of whether the market goes up or down.

Manage Your Risk:

Ensuring a risk management plan is crucial. This might include setting stop-loss orders to limit possible losses and take-profit orders to lock in profits once the price hits a specified level set. Also, consider how much you are prepared to lose if a trade goes against you.

Monitor Your Trade & Exit the Position

After opening your trade, it's essential to regularly track the market's performance. You can manually close your position when you think it is appropriate or sets orders to automatically close it at a designated price level.

Remember, it’s best to start with a clear trading plan and try to avoid letting your emotions influence your trading decisions.

When you become a Baxia client, you will have access to all cryptocurrency pairs to start trading.

You can trade the following cryptocurrencies:

• AVXUSD – Avax (Avalanche) Vs US Dollar

• AVEUSD – Aave Vs US Dollar

• ADAUSD – Cardano Vs US Dollar

• ATMUSD – Cosmos (Atom) Vs US Dollar

• BATUSD – Basic Attention Token Vs US Dollar

• BNBUSD – Binance Coin Vs US Dollar

• BTCUSD – Bitcoin Vs US Dollar

• BCHUSD – Bitcoin Cash vs US Dollar

• CRVUSD – Curve Vs US Dollar

• CMPUSD – Compound Vs US Dollar

• DOTUSD – Polkadot Vs US Dollar

• DOGUSD – Doge Vs US Dollar

• ETHUSD – Etherium Vs US Dollar

• EOSUSD – EOS Vs US Dollar

• KSMUSD – Kusama Vs US Dollar

• LTCUSD – Litecoin Vs US Dollar

• LRCUSD – Loopring Vs US Dollar

• MANUSD – Decentraland (MANA) Token Vs US Dollar

• MKRUSD – Maker Vs US Dollar

• MATUSD – Polygon (MATIC) Vs US Dollar

• NERUSD – NEAR Protocol Vs US Dollar

• OMGUSD – OMG Network Vs US Dollar

• SOLUSD – Solana Vs US Dollar

• SNDUSD – The Sandbox (SAND) Vs US Dollar

• SUSUSD – SushiSwap (SUSHI) Vs US Dollar

• TRXUSD – Tron Vs US Dollar

• XLMUSD – Stellar Lumens Vs US Dollar

• XRPUSD – Ripple Vs US Dollar

• XTZUSD – Tezos Vs US Dollar

All order types available in the MT5 platform are supported, such as:

Yes, we offer CFDs on cryptocurrencies. CFDs are leveraged, giving you full market exposure at a fraction of the initial outlay required when buying actual cryptos. However, it’s also important to understand that trading CFDs comes with a high risk of losing money rapidly due to leverage.

Yes.

Daily statements will be sent to your email address on file. You can also generate statements directly from your MT5 platform as needed.

You can trade cryptocurrencies 24/7.

Cryptocurrency trading inherently carries substantial risk due to the market’s volatility, and leveraged derivatives like CFDs can magnify these intense and swift market shifts.

To get a better idea of the costs of trading associated with crypto, consider opening a demo account. You’ll get virtual funds to trade not only cryptos, but other popular markets as well.

There are primarily two methods to trade cryptocurrency. First, you can buy and sell actual cryptocurrency coins on an exchange. In this situation, you would need to pay the full value of the coins upfront, as well as needing to open an account on an exchange and creating a digital wallet for the coins. Baxia doesn’t offer this.

Second, you can speculate on cryptocurrency price movements using CFDs. These are derivative products, meaning you won’t buy and sell actual coins. Additionally, you won’t need an account with an exchange, and you won’t need a digital wallet.

Trading derivatives such as CFDs allows you to take a position in both rising and declining markets–meaning you can go long (or ‘buy’) if you think the cryptocurrency will increase in value, or go short (or ‘sell’) if you think it will decline in value. If you owned the actual coins, by comparison, you would only be able to profit if you sold your coins higher than what you paid for them.

Since CFDs are leverage products, you can open a trade by outlaying an initial amount that’s only a fraction of your total exposure to the market. Yet, this leverage can also intensify risks, leading to swift potential losses, particularly in fluctuating and uncertain markets like cryptocurrencies.

In the case of trading CFDs, your losses could exceed your initial deposit. When trading, it’s crucial to always take steps to manage your risk.

Cryptocurrency markets fluctuate based on supply and demand dynamics. Given their decentralized nature, they often stay unaffected by numerous economic and political factors that influence conventional currencies. While there still is uncertainty around cryptocurrency, the following factors can have a big impact on their prices:

• Supply: the sum or total number of coins and the rate at which they’re released, destroyed or lost

• Market capitalization: the value of all the coins in existence and how users expect or anticipate this to be developing

• Press: this is how cryptocurrency is portrayed in the media, as well as how much coverage it is getting worldwide

• Integration: this is the extent to which the cryptocurrency easily integrates into existing infrastructure such as e-commerce payment systems

• Key events: major market events such as regulatory updates, security breaches, as well as economic setbacks

Yes, like any other market, you can profit from cryptocurrency trading if you accurately predict price direction and timing of price movements. However, the volatility of cryptocurrency markets makes them high-risk. Favorable price shifts can yield positive returns, but adverse shifts can lead to rapid and substantial losses.

When using leverage in trading, which magnifies both gains and losses, your risk is increased due to the nature of volatile markets. Before diving into trading, you should always consider whether you can afford potential losses, and as always, make sure you take steps to manage your exposure to risk.

The main difference between a digital currency and a cryptocurrency is that the latter is decentralized. This means cryptos are not issued or backed by a central authority such as a central bank or government. Instead, they operate over a network of computers. While digital currencies embody the features of traditional currencies, they exist solely in the digital realm.

The first cryptocurrency created was Bitcoin. Its domain was established in 2008, but the first transaction happened in 2009. It was made by someone named ‘Satoshi Nakamoto’. However, there is some speculation around this and some people think this is a fake name because no one really knows who ‘he’ is or if it’s even just one person.

More than 1000 CFD instruments to trade on multiple asset classes with one broker.

Forex

Precious Metals

Energy

Indices

Commodities

Shares

BAXIA GLOBAL LIMITED

Join the community

Risk Warning: Margin trading involves a high level of risk, and may not be suitable for all investors. You should carefully consider your objectives, financial situation, needs and level of experience before entering into any margined transactions with Baxia Markets, and seek independent advice if necessary. Forex and CFDs are highly leveraged products which mean both gains and losses are magnified. You should only trade in these products if you fully understand the risks involved and can afford losses without adversely affecting your lifestyle (including the risk of losing the entirety of your initial investment). You must assess and consider them carefully before making any decision about using our products or services.

Baxia Global Limited is a company registered in Seychelles with registration number: 8426970-1, and is regulated by the Financial Services Authority of Seychelles with License number: SD104.

Baxia Limited is a company registered in The Bahamas with registration number: 177330 B, and is licensed and regulated by The Securities Commission of The Bahamas (SCB), (SIA-F234).

The information on this website is general in nature and doesn’t take into account your personal objectives, financial circumstances, or needs. It is not targeted at the general public of any specific country and is not intended for distribution to residents in any jurisdiction where that distribution would be unlawful or contravene regulatory requirements. Baxia Markets does not offer its services to residents of certain jurisdictions such as USA, Cuba, Sudan/Republic of Sudan, Syria, Iran, Iraq, South Sudan, Venezuela, Libya, Belarus, Afghanistan, Myanmar, Russia, Crimea, Donetsk, Luhansk, Palestine, Yemen, Zimbabwe and North Korea.