%D = simple moving average of %K (3 period simple moving average is the most common)

- CFDs & Forex Trading | Regulated Online Trading

- About Us

- Trading

- Platforms

- Resources

- Partners

- Research

Search

×

The Stochastic Oscillator is a momentum indicator that compares a specific closing price of an asset to a range of its prices over a certain period of time. Its core premise is that during an upward trending market, prices will tend to close near their highs, and during a downward trend, they will close near their lows. Let’s delve into its intricacies:

The Stochastic Oscillator is a momentum indicator that gauges the relationship between a security’s closing price and its price range over a specified duration. Specifically, it produces values ranging from 0 to 100 and is commonly used to pinpoint overbought or oversold states in a traded asset.

• %K which is the main line, often termed the “fast stochastic.”

• %D, a simple moving average of %K, known as the “slow stochastic.” Usually a 3-day simple moving average.

The standard settings for these lines are 14 periods for %K and 3 periods for %D.

%K = 100(C - L14) / (H14 - L14)

where:

C = the instrument’s most recent closing price

L14 = the instrument’s lowest price of the 14-day period

H14 = the instrument’s highest price of the 14-day period

%D = simple moving average of %K (3 period simple moving average is the most common)

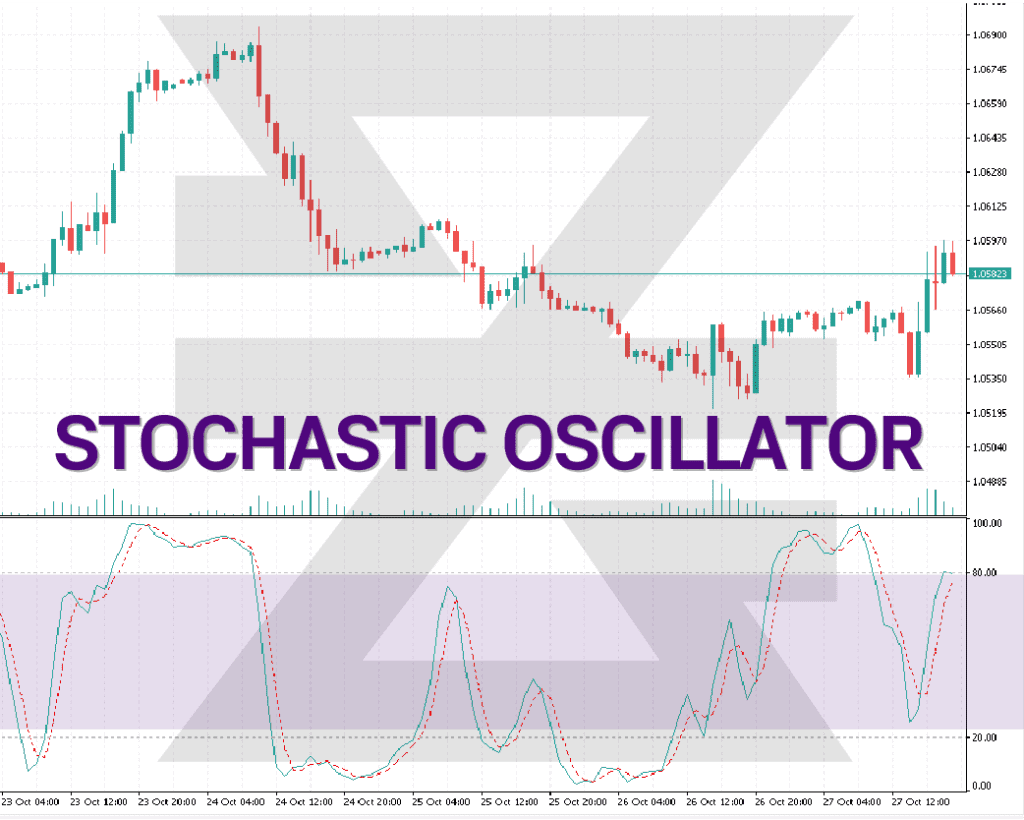

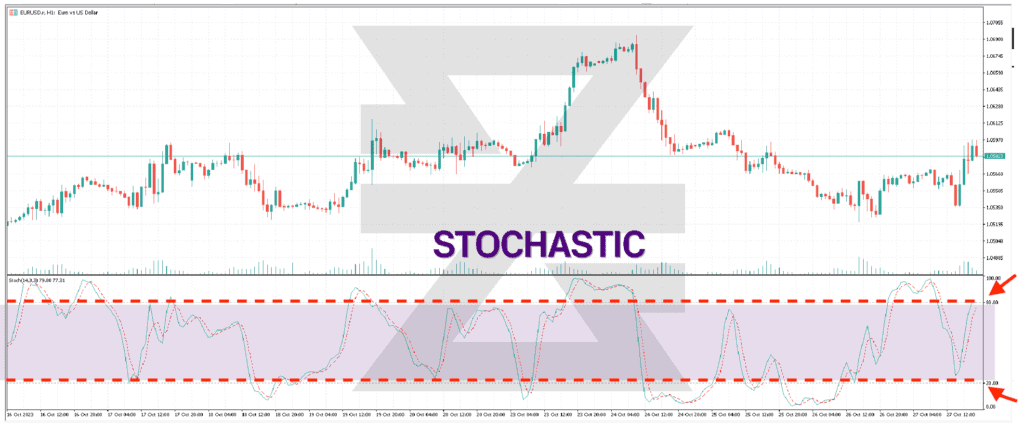

• Overbought/Oversold Conditions:

A Stochastic Oscillator value above 80 is generally considered to signify that the asset may be overbought. Conversely, a value below 20 suggests that the asset might be oversold.

• Crossovers:

A bullish crossover occurs when %K crosses above %D, signaling potential upward momentum. A bearish crossover happens when %K crosses below %D, indicating potential downward momentum.

• Divergences:

A bullish divergence is observed when the price records a lower low, but the Stochastic Oscillator forms a higher low, signaling weakening downward momentum. Conversely, a bearish divergence is when the price achieves a higher high, but the oscillator forms a lower high, suggesting a potential reversal to the downside.

• Be Aware of False Signals:

The Stochastic Oscillator can sometimes provide false signals, especially in strongly trending markets. For instance, the oscillator might indicate overbought conditions during a strong uptrend when the asset can still rise significantly.

• Best in Ranging Markets:

The Stochastic Oscillator tends to perform best in ranging (non-trending) markets, where price oscillates between consistent highs and lows.

• Confirmation is Key:

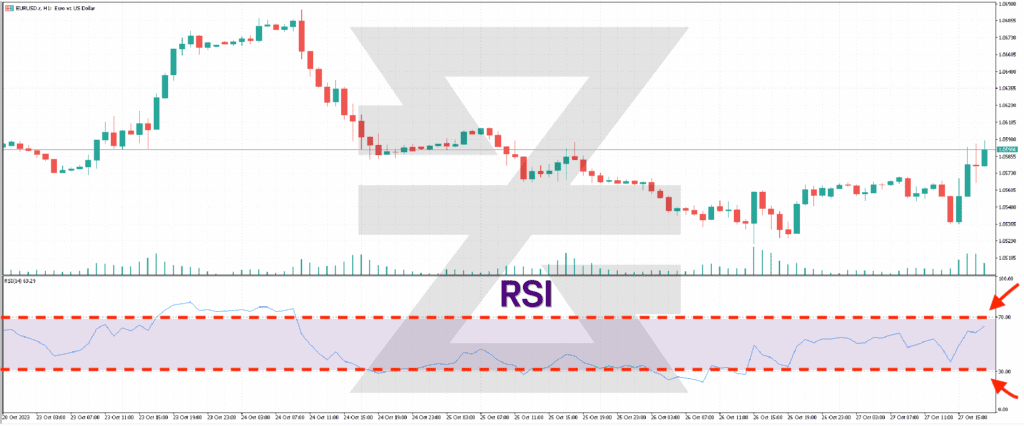

As with most technical indicators, the Stochastic Oscillator should be used with other indicators and analysis methods to confirm its signals and minimize the risk of acting on false indications.

Developed in the 1950s by George Lane, the Stochastic Oscillator’s primary aim was to identify the speed or momentum of price. Lane believed that momentum changed direction before the price did, making this oscillator a leading indicator.

The Stochastic Oscillator is a potent tool for determining potential trend reversals and the strength of price movements. It’s particularly valued for its ability to highlight overbought and oversold conditions in the Forex CFD market. Traders, however, should be cautious and ensure they integrate insights from the Stochastic Oscillator with other technical analysis tools and a robust risk management strategy to enhance its effectiveness.

Check out top trading indicators, including Stochastic Oscillator, and how they are used to make profit in this helpful video

→

Want to learn more? Discover more important concepts used in technical analysis for forex trading or view more trading indicators below

Start placing forex trades with a Baxia trading account

Looking for more?

Explore our Education Center

View our collection of free education resources dedicated to help you become a more informed and confident trader.

BAXIA GLOBAL LIMITED

Join the community

Risk Warning: Margin trading involves a high level of risk, and may not be suitable for all investors. You should carefully consider your objectives, financial situation, needs and level of experience before entering into any margined transactions with Baxia Markets, and seek independent advice if necessary. Forex and CFDs are highly leveraged products which mean both gains and losses are magnified. You should only trade in these products if you fully understand the risks involved and can afford losses without adversely affecting your lifestyle (including the risk of losing the entirety of your initial investment). You must assess and consider them carefully before making any decision about using our products or services.

Baxia Global Limited is a company registered in Seychelles with registration number: 8426970-1, and is regulated by the Financial Services Authority of Seychelles with License number: SD104.

Baxia Limited is a company registered in The Bahamas with registration number: 177330 B, and is licensed and regulated by The Securities Commission of The Bahamas (SCB), (SIA-F234).

The information on this website is general in nature and doesn’t take into account your personal objectives, financial circumstances, or needs. It is not targeted at the general public of any specific country and is not intended for distribution to residents in any jurisdiction where that distribution would be unlawful or contravene regulatory requirements. Baxia Markets does not offer its services to residents of certain jurisdictions such as USA, Cuba, Sudan/Republic of Sudan, Syria, Iran, Iraq, South Sudan, Venezuela, Libya, Belarus, Afghanistan, Myanmar, Russia, Crimea, Donetsk, Luhansk, Palestine, Yemen, Zimbabwe and North Korea.