- CFDs & Forex Trading | Regulated Online Trading

- About Us

- Trading

- Platforms

- Resources

- Partners

- Research

Search

×

| Symbol | XPDUSD |

| Name | Palladium vs US Dollar |

| Quote Currency | USD |

| Monday Open | 01:00 |

| Friday Close | 23:50 |

| Session Break | Daily: 23:55 - 01:00 |

| Spread As Low as (Quote Currency) | 2.35 |

| Commission | No |

| Contract Size (Per Lot) | 100 Troy Ounces |

| Minimum Contract Size (Lot) | 0.01 |

| Minimum Step Size (Lot) | 0.01 |

| Limit and Stop Level | 0 |

| Leverage Up To | 1:200 |

| Execution | Market |

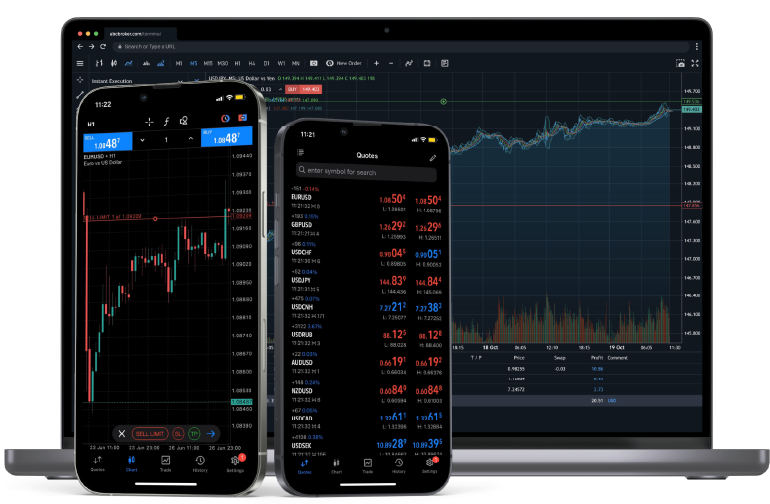

| Trading Platform | MT5, Mobile App, WebTrader |

| Sector | Metals |

ZERO Deposit Fees

Choose from multiple (15+) deposit options such as Skrill, Neteller, Visa/Mastercard, Crypto, Local Bank and others with zero fees.

Global Market Access

Trade CFD's (1000+) on a wide range of instruments including Forex, Shares, Commodities, Indices, Precious Metals, Cryptocurrency and Energy.

6 Ways to Trade

Trade when you want and anywhere at your convenience with Windows OS, MacOS, iOS, Android, WebTrader and even Linux.

Sub 30ms Latency Trading

Trades are executed through liquidity engines in LD4 and access servers in Asia, Europe and Africa.

Supports Proprietary Trading

Get access up to $2 million in funded trading for qualified profitable traders on MT5.

24/5 Unparalleled Service

Knowledgable and prompt service available on Live Chat, Email, Phone, Whatsapp and Telegram.

Choose from multiple trading options based on your preference of order types, indicators, charting tools, style of trading and operating environment.

XPDUSD combines Palladium (XPD), a precious metal with extensive industrial applications, particularly in the automotive sector, with the US Dollar (USD), the global benchmark currency. The price of Palladium, like other precious metals, is subject to diverse influences, making it an intriguing option for Spot CFD traders seeking portfolio diversification.

Industrial Demand:

Palladium's primary use is in catalytic converters for gasoline-powered vehicles, which means its price is closely linked to the automotive industry's health.

Supply Constraints:

Palladium supply is geographically concentrated, with major production in Russia and South Africa. This concentration can lead to supply disruptions and price volatility.

Economic Trends:

The overall health of the global economy, particularly in major automobile markets like China and the United States, can impact Palladium demand and prices.

Technological Developments:

Advances in automotive technology, including shifts towards electric vehicles, can influence Palladium demand.

Investment Demand:

Apart from industrial use, Palladium is also an investment commodity. Investor interest in precious metals as a hedge against inflation and currency devaluation can affect its price.

For traders, understanding the factors influencing Palladium prices, from global economic trends to industry-specific developments, is key to capitalizing on the opportunities this market presents.

Monitor Automotive Industry Trends

Given Palladium's heavy use in vehicle manufacturing, staying updated on automotive industry health is crucial.

Global Economic Indicators

Economic data from key markets can provide insights into potential Palladium demand.

Technical Analysis

Employing technical analysis tools can help in identifying trends and potential trade opportunities in the XPDUSD market.

Risk Management

Palladium's price can be volatile, making robust risk management strategies essential for successful CFD trading.

Start trading XPDUSD now!

The price of palladium is influenced by factors such as global industrial demand (especially from the automotive industry for catalytic converters), mining and supply constraints, geopolitical events, trends in other precious metals markets, and overall market risk sentiment.

Economic conditions, particularly in the automotive industry which is a major consumer of palladium, significantly impact palladium prices. Economic growth can increase demand for palladium, while a downturn can reduce it.

Palladium CFDs can be traded throughout the trading week, with higher liquidity and volatility often observed during the overlap of major global trading sessions, particularly the European and U.S. sessions.

Traders commonly use strategies such as technical analysis, fundamental analysis, and trend following for palladium CFDs. Keeping abreast of industrial demand trends and supply factors is also crucial for trading in this market.

Interest rate decisions from major central banks can influence palladium prices. Higher interest rates can lead to a stronger local currency, potentially making palladium more expensive and reducing demand. Lower rates can have the opposite effect.

The U.S. dollar has a significant relationship with palladium prices. A weaker dollar can make palladium more affordable for holders of other currencies, possibly increasing demand, while a stronger dollar can decrease its appeal.

Yes, geopolitical events that impact global economic stability, specific palladium mining regions, or major industrial sectors can affect palladium prices.

New traders should understand the dynamics of the palladium market, including the factors influencing supply and demand, and develop a sound risk management strategy. It’s important to understand how CFDs work, particularly the implications of leverage.

Beginner or Advanced? View our full suite of tools and resources to help traders of all levels.

Get started quickly with our free forex trading course for beginners to level up on your trading knowledge.

Evaluate your risk, monitor profit or loss for each trade & estimate trading costs with our full suite of calculators.

Follow high impact news and events for the financial markets including the latest economic data.

Stay up to date with the latest fundamental and technical analysis from the Baxia Markets Analyst team.

Find answers to common questions and topics related to trading with Baxia Markets and the trading platforms.

View our collection of free educational resources to help you become a profitable trader and learn risk management.

More than 1000 CFD instruments to trade on multiple asset classes with one broker.

Forex

Precious Metals

Crypto CFDs

Energy

Indices

Commodities

Shares

BAXIA GLOBAL LIMITED

Join the community

Risk Warning: Margin trading involves a high level of risk, and may not be suitable for all investors. You should carefully consider your objectives, financial situation, needs and level of experience before entering into any margined transactions with Baxia Markets, and seek independent advice if necessary. Forex and CFDs are highly leveraged products which mean both gains and losses are magnified. You should only trade in these products if you fully understand the risks involved and can afford losses without adversely affecting your lifestyle (including the risk of losing the entirety of your initial investment). You must assess and consider them carefully before making any decision about using our products or services.

Baxia Global Limited is a company registered in Seychelles with registration number: 8426970-1, and is regulated by the Financial Services Authority of Seychelles with License number: SD104.

Baxia Limited is a company registered in The Bahamas with registration number: 177330 B, and is licensed and regulated by The Securities Commission of The Bahamas (SCB), (SIA-F234).

The information on this website is general in nature and doesn’t take into account your personal objectives, financial circumstances, or needs. It is not targeted at the general public of any specific country and is not intended for distribution to residents in any jurisdiction where that distribution would be unlawful or contravene regulatory requirements. Baxia Markets does not offer its services to residents of certain jurisdictions such as USA, Cuba, Sudan/Republic of Sudan, Syria, Iran, Iraq, South Sudan, Venezuela, Libya, Belarus, Afghanistan, Myanmar, Russia, Crimea, Donetsk, Luhansk, Palestine, Yemen, Zimbabwe and North Korea.