- CFDs & Forex Trading | Regulated Online Trading

- About Us

- Trading

- Platforms

- Resources

- Partners

- Research

Search

×

| Symbol | USOIL |

| Name | WTI (US) Spot Oil CFD |

| Quote Currency | USD |

| Monday Open | 01:05 |

| Friday Close | 23:10 |

| Session Break | 23:59 - 01:00 |

| Spread As Low as (Quote Currency) | 0.03 |

| Commission | No |

| Contract Size (Per Lot) | 100 Barrels |

| Minimum Contract Size (Lot) | 0.1 |

| Minimum Step Size (Lot) | 0.1 |

| Limit and Stop Level | 0 |

| Leverage Up To | 1:100 |

| Execution | Market |

| Trading Platform | MT5, Mobile App, WebTrader |

| Sector | Energy |

ZERO Deposit Fees

Choose from multiple (15+) deposit options such as Skrill, Neteller, Visa/Mastercard, Crypto, Local Bank and others with zero fees.

Global Market Access

Trade CFD's (1000+) on a wide range of instruments including Forex, Shares, Commodities, Indices, Precious Metals, Cryptocurrency and Energy.

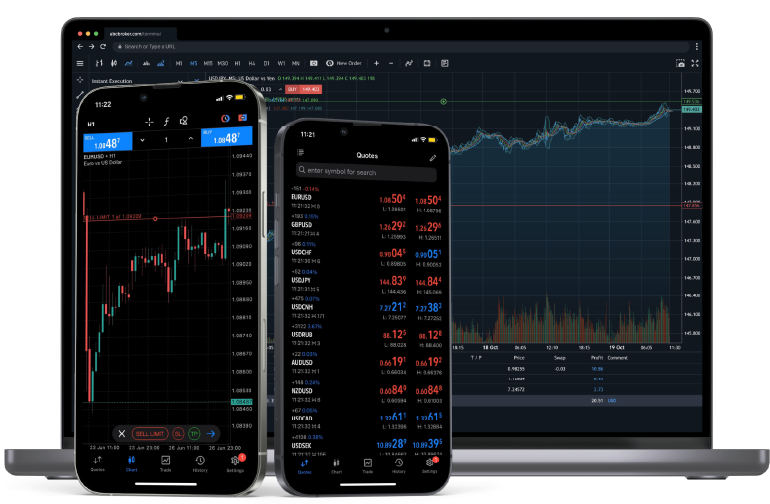

6 Ways to Trade

Trade when you want and anywhere at your convenience with Windows OS, MacOS, iOS, Android, WebTrader and even Linux.

Sub 30ms Latency Trading

Trades are executed through liquidity engines in LD4 and access servers in Asia, Europe and Africa.

Supports Proprietary Trading

Get access up to $2 million in funded trading for qualified profitable traders on MT5.

24/5 Unparalleled Service

Knowledgable and prompt service available on Live Chat, Email, Phone, Whatsapp and Telegram.

Choose from multiple trading options based on your preference of order types, indicators, charting tools, style of trading and operating environment.

US Oil or WTI (West Texas Intermediate) is a grade of crude oil used as a benchmark in oil pricing. It is extracted primarily in the United States, specifically from Texas, and is known for its relatively low density and sulfur content, making it a “sweet” crude oil. In the context of CFD trading, WTI represents an opportunity to speculate on the price movements of one of the most traded commodities in the world, without physically owning it.

Supply and Demand Dynamics:

The fundamental driver of US Oil prices is the global balance of supply and demand. Economic activity, technological advancements in energy, and alternative energy sources influence this balance.

Geopolitical Events:

Political instability or conflicts in key oil-producing regions can lead to supply disruptions, thereby affecting prices.

US Energy Policies:

Decisions and regulations by the US government regarding energy, including drilling regulations, environmental policies, and trade agreements, significantly impact WTI pricing.

OPEC’s Production Policies:

The Organization of the Petroleum Exporting Countries (OPEC) plays a crucial role in determining global oil supply and, consequently, WTI prices.

Currency Fluctuations:

Oil prices are typically inversely related to the strength of the US Dollar, as oil is globally traded in dollars.

Trading US Oil in the form of CFDs allows traders to speculate on the price of WTI crude oil without the complexities of handling physical barrels. Traders can take positions based on their analysis of market trends and price movements.

Stay Informed on Global Events

Keeping abreast of global news, especially related to oil-producing regions and US energy policies, is vital.

Monitor Industry Reports

Regularly review industry reports on oil inventories, production levels, and consumption patterns.

Leverage Technical Analysis

Employing charting tools and technical indicators can help predict price trends and trading opportunities.

Risk Management

Implementing effective risk management strategies, such as stop-loss orders, is critical due to the inherent volatility of the oil market.

Start trading WTI Crude Oil (USOIL) now!

WTI crude oil prices are influenced by a variety of factors, including global supply and demand dynamics, geopolitical events, decisions by major oil-producing countries (OPEC and non-OPEC), economic indicators that affect oil consumption (like GDP growth), inventory levels, and broader market sentiment.

Geopolitical events, particularly in major oil-producing regions like the Middle East, can significantly impact WTI crude oil prices. Conflicts, political instability, or diplomatic tensions can affect oil supply, leading to price volatility.

Decisions made by OPEC (Organization of the Petroleum Exporting Countries) regarding oil production quotas can have a significant impact on WTI crude oil prices. Increases in production generally lead to lower prices, while production cuts can lead to higher prices.

Economic indicators that suggest global economic growth or contraction can impact oil demand forecasts, thereby influencing WTI crude oil prices. Indicators such as GDP growth, manufacturing data, and employment rates are closely watched by oil traders.

The best times to trade WTI crude oil CFDs are typically during periods of high liquidity, which often occur during the overlap of the European and U.S. trading sessions and when major oil-related news or economic reports are released.

Traders often employ strategies such as technical analysis, fundamental analysis, trend following, and news-based trading for WTI crude oil CFDs. Understanding the oil market’s specifics and keeping up with relevant news is crucial.

WTI crude oil prices are inversely related to the strength of the U.S. dollar. A stronger dollar can make oil more expensive for holders of other currencies, potentially reducing demand and lowering prices.

New traders should be aware of the volatility and complexities of the oil market, understand the economic and geopolitical factors that influence oil prices, and develop a comprehensive risk management strategy.

Beginner or Advanced? View our full suite of tools and resources to help traders of all levels.

Get started quickly with our free forex trading course for beginners to level up on your trading knowledge.

Evaluate your risk, monitor profit or loss for each trade & estimate trading costs with our full suite of calculators.

Follow high impact news and events for the financial markets including the latest economic data.

Stay up to date with the latest fundamental and technical analysis from the Baxia Markets Analyst team.

Find answers to common questions and topics related to trading with Baxia Markets and the trading platforms.

View our collection of free educational resources to help you become a profitable trader and learn risk management.

More than 1000 CFD instruments to trade on multiple asset classes with one broker.

Forex

Precious Metals

Crypto CFDs

Energy

Indices

Commodities

Shares

BAXIA GLOBAL LIMITED

Join the community

Risk Warning: Margin trading involves a high level of risk, and may not be suitable for all investors. You should carefully consider your objectives, financial situation, needs and level of experience before entering into any margined transactions with Baxia Markets, and seek independent advice if necessary. Forex and CFDs are highly leveraged products which mean both gains and losses are magnified. You should only trade in these products if you fully understand the risks involved and can afford losses without adversely affecting your lifestyle (including the risk of losing the entirety of your initial investment). You must assess and consider them carefully before making any decision about using our products or services.

Baxia Global Limited is a company registered in Seychelles with registration number: 8426970-1, and is regulated by the Financial Services Authority of Seychelles with License number: SD104.

Baxia Limited is a company registered in The Bahamas with registration number: 177330 B, and is licensed and regulated by The Securities Commission of The Bahamas (SCB), (SIA-F234).

The information on this website is general in nature and doesn’t take into account your personal objectives, financial circumstances, or needs. It is not targeted at the general public of any specific country and is not intended for distribution to residents in any jurisdiction where that distribution would be unlawful or contravene regulatory requirements. Baxia Markets does not offer its services to residents of certain jurisdictions such as USA, Cuba, Sudan/Republic of Sudan, Syria, Iran, Iraq, South Sudan, Venezuela, Libya, Belarus, Afghanistan, Myanmar, Russia, Crimea, Donetsk, Luhansk, Palestine, Yemen, Zimbabwe and North Korea.