- CFDs & Forex Trading | Regulated Online Trading

- About Us

- Trading

- Platforms

- Resources

- Partners

- Research

Search

×

Why do you keep hearing about this date people are calling bitcoin halving? What is so special about bitcoin halving?

Today we will explain what exactly happens on these bitcoin halving dates and how it affects the price of bitcoin.

SHARE THIS ARTICLE:

Anything that is scarce tends to have some sort of value. Bitcoin is built around that very idea. There will only ever be 21 million bitcoins. By definition, bitcoin will have a finite supply. This is one of the reasons why there is so much demand for bitcoin.

If you are familiar with bitcoin, you will know that bitcoins have to be mined. Bitcoin mining is the process by which new bitcoins are entered into circulation, but it is also a critical component of the maintenance and development of the blockchain ledger. It is performed using very sophisticated computers that solve extremely complex computational math problems.

Mining bitcoin was once extremely lucrative. But to mine bitcoin today, you will need a serious investment. In simple terms, mining bitcoin involves packaging 1 megabyte’s worth of transactions into a block. After doing so you collect the transaction fee; an associated “block reward” is unlocked with every new block. Block rewards started out at 50 BTC per block. That today is an insane amount of money. Life changing money.

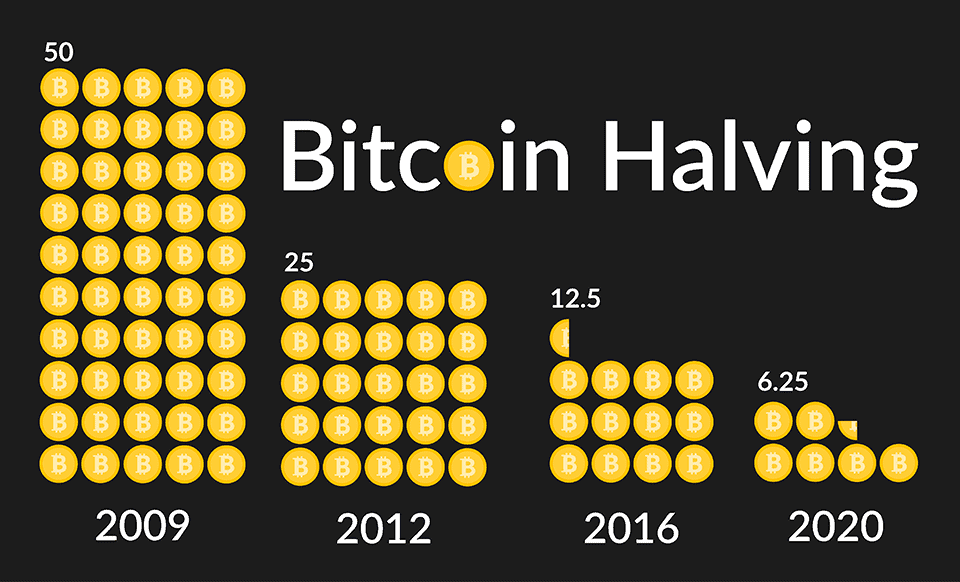

For every 210,000 blocks (roughly every 4 years) that are created, the block reward gets cut in half. This is what people refer to as “The Halvening” or “Halving.” To break it down for you, essentially, the reward you are getting for doing the same amount of work is cut in half.

On November 28, 2012 the block reward was cut to 25 BTC per block. On July 9, 2016 the block reward was cut in half again to 12.5 BTC. And most recently on May 11, 2020 the latest halving of the block reward took place. Today the block reward is 6.25 BTC. The next halving will occur sometime in spring of 2024, when the block reward will be reduced to 3.125. And the next one is expected to be in 2028.

Mining bitcoin is not cheap. Miners use an insane amount of electricity to mine a single bitcoin. With the reward of mining a single bitcoin decreasing every four years you can imagine that some miners can be a little discouraged. But at the end of the day the only way the math makes sense for the miners is for the price of Bitcoin to go up. So as the price continues to go up, miners will continue to mine.

Halving cycles tend to have an effect on the price of bitcoin. In previous examples, when approaching the halving date and immediately following the halving date, the price of bitcoin has experienced a bullish trend. To no surprise, these bull runs have been followed by crashes. The crashes are followed by long “crypto winters” where belief isn’t as high and major news networks no longer report on Bitcoin. The next halving cycle then starts the process again.

Anything that is scarce tends to have some sort of value. Bitcoin is built around that very idea. There will only ever be 21 million bitcoins. By definition, bitcoin will have a finite supply. This is one of the reasons why there is so much demand for bitcoin.

If you are familiar with bitcoin, you will know that bitcoins have to be mined. Bitcoin mining is the process by which new bitcoins are entered into circulation, but it is also a critical component of the maintenance and development of the blockchain ledger. It is performed using very sophisticated computers that solve extremely complex computational math problems.

With Baxia Markets we make it very easy for you to get started with your trading journey. Feel free to reach out to us via chat, email or call and we will be more than happy to help you get started. Our dedicated and experienced Account Managers will make sure you have all you need to get started in a swift manner. Baxia Markets offers both Demo and Live Accounts so that we can accommodate all levels of traders.

Start placing trades with a Baxia Markets trading account

Related Articles

View our collection of free education resources dedicated to help you become a more informed and confident trader.

BAXIA GLOBAL LIMITED

Join the community

Risk Warning: Margin trading involves a high level of risk, and may not be suitable for all investors. You should carefully consider your objectives, financial situation, needs and level of experience before entering into any margined transactions with Baxia Markets, and seek independent advice if necessary. Forex and CFDs are highly leveraged products which mean both gains and losses are magnified. You should only trade in these products if you fully understand the risks involved and can afford losses without adversely affecting your lifestyle (including the risk of losing the entirety of your initial investment). You must assess and consider them carefully before making any decision about using our products or services.

Baxia Global Limited is a company registered in Seychelles with registration number: 8426970-1, and is regulated by the Financial Services Authority of Seychelles with License number: SD104.

Baxia Limited is a company registered in The Bahamas with registration number: 177330 B, and is licensed and regulated by The Securities Commission of The Bahamas (SCB), (SIA-F234).

The information on this website is general in nature and doesn’t take into account your personal objectives, financial circumstances, or needs. It is not targeted at the general public of any specific country and is not intended for distribution to residents in any jurisdiction where that distribution would be unlawful or contravene regulatory requirements. Baxia Markets does not offer its services to residents of certain jurisdictions such as USA, Cuba, Sudan/Republic of Sudan, Syria, Iran, Iraq, South Sudan, Venezuela, Libya, Belarus, Afghanistan, Myanmar, Russia, Crimea, Donetsk, Luhansk, Palestine, Yemen, Zimbabwe and North Korea.