- CFDs & Forex Trading | Regulated Online Trading

- About Us

- Trading

- Platforms

- Resources

- Partners

- Research

Search

×

| Symbol | NERUSD |

| Name | Near vs US Dollar |

| Quote Currency | USD |

| Trading Hours | 24/7 |

| Spread As Low as (Quote currency) | 0.035 |

| Commission | No |

| Contract Size (Per Lot) | 1000 NER |

| Minimum Contract Size (Lot) | 0.01 |

| Minimum Step Size (Lot) | 0.01 |

| Leverage Up To | 1:100 |

| Limit and Stop Level | 0 |

| Execution | Market |

| Trading Platform | MT5, Mobile App, WebTrader |

| Sector | Crypto |

ZERO Deposit Fees

Choose from multiple (15+) deposit options such as Skrill, Neteller, Visa/Mastercard, Crypto, Local Bank and others with zero fees.

Global Market Access

Trade CFD's (1000+) on a wide range of instruments including Forex, Shares, Commodities, Indices, Precious Metals, Cryptocurrency and Energy.

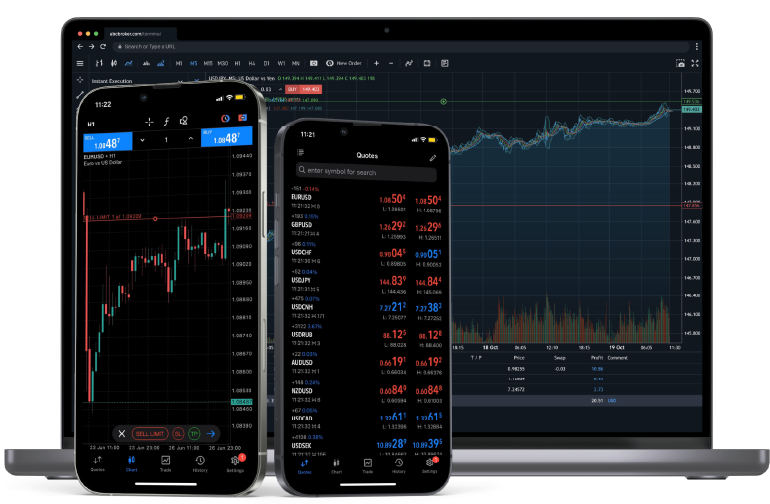

6 Ways to Trade

Trade when you want and anywhere at your convenience with Windows OS, MacOS, iOS, Android, WebTrader and even Linux.

Sub 30ms Latency Trading

Trades are executed through liquidity engines in LD4 and access servers in Asia, Europe and Africa.

Supports Proprietary Trading

Get access up to $2 million in funded trading for qualified profitable traders on MT5.

24/5 Unparalleled Service

Knowledgable and prompt service available on Live Chat, Email, Phone, Whatsapp and Telegram.

Choose from multiple trading options based on your preference of order types, indicators, charting tools, style of trading and operating environment.

As the blockchain industry evolves, a new wave of platforms is arising, aiming to tackle the longstanding issues of scalability, usability, and decentralization. One such promising contender is the NEAR Protocol. With its fresh perspective on blockchain infrastructure and its native token, NEAR, it has captured the attention of the Contract for Difference (CFD) trading community. This article aims to shed light on the intricacies of NEAR Protocol, offering a comprehensive look into its underlying principles and its influence on the CFD trading arena.

Launched in 2020, the NEAR Protocol’s mission revolves around simplifying the process of building and deploying decentralized applications (dApps).

By focusing on user experience and developer ease, it aims to usher in a broader adoption of blockchain technologies.

Sharded Design

Adopting a unique version of sharding, the NEAR Protocol ensures scalability by dividing the network into smaller components, allowing for parallel transaction processing and increased capacity.

Developer-Friendly

NEAR champions a developer-oriented approach, providing tools and frameworks that facilitate easier dApp creation. This is pivotal in driving the blockchain application ecosystem forward.

NEAR Token

Serving as the protocol's native utility token, NEAR is used to compensate validator nodes, pay for transaction and storage costs, and participate in network governance.

Economic Model

NEAR Protocol uses a unique "Economics of a Stateless Blockchain" model, balancing incentives and ensuring network security without excessive costs.

Given its innovative architecture and market potential, the NEAR token holds a significant position in the CFD trading space. Traders watch these:

Ecosystem Growth: As more dApps and projects build on the NEAR Protocol, the intrinsic value and demand for the NEAR token may shift, creating potential CFD trading opportunities.

Network Milestones: Important updates, governance decisions, or partnership announcements within the NEAR ecosystem can act as catalysts for NEAR token’s price movements in the CFD market.

Interoperability Ventures: NEAR Protocol’s endeavors to integrate with other blockchains or establish cross-chain bridges can influence its market dynamics, impacting CFD trading strategies.

The NEAR Protocol, with its emphasis on bridging the gap between complexity and usability, stands out as a beacon in the next-generation blockchain platforms. By fostering an environment conducive to developer growth and mainstream adoption, it holds promise for reshaping the decentralized landscape. For CFD traders, the NEAR token offers a tapestry of technological innovation, market volatility, and speculative depth, making it a captivating asset in the digital trading realm.

Start trading NER/USD (NEAR) crypto CFD now!

NEAR Protocol is a decentralized application platform designed to make apps usable on the web. Its unique sharding and scaling solutions make it stand out in the crypto space.

To trade NER/USD (NEAR) crypto CFDs, you need to have an account with a broker that offers crypto CFDs, such as Baxia Markets. After depositing funds, you can take either a long (buy) or short (sell) position based on your market prediction.

Factors include NEAR Protocol development updates, overall crypto market sentiment, regulatory news, and any partnerships or collaborations the NEAR Protocol enters into.

Buying NEAR tokens means owning the actual cryptocurrency and holding it in a wallet. Trading NER/USD crypto CFDs means you’re speculating on price movements without owning the cryptocurrency.

Typically, you can trade crypto CFDs 24/7, but various broker trading hours can be different. Here at Baxia Markets, we offer our clients the ability to access and trade NER/USD anytime 24/7.

Use risk management tools like stop-loss and take-profit orders, diversify your trading portfolio, and regularly update yourself with NEAR Protocol and market news.

Beginner or Advanced? View our full suite of tools and resources to help traders of all levels.

Get started quickly with our free forex trading course for beginners to level up on your trading knowledge.

Evaluate your risk, monitor profit or loss for each trade & estimate trading costs with our full suite of calculators.

Follow high impact news and events for the financial markets including the latest economic data.

Stay up to date with the latest fundamental and technical analysis from the Baxia Markets Analyst team.

Find answers to common questions and topics related to trading with Baxia Markets and the trading platforms.

View our collection of free educational resources to help you become a profitable trader and learn risk management.

More than 1000 CFD instruments to trade on multiple asset classes with one broker.

Forex

Precious Metals

Crypto CFDs

Energy

Indices

Commodities

Shares

BAXIA GLOBAL LIMITED

Join the community

Risk Warning: Margin trading involves a high level of risk, and may not be suitable for all investors. You should carefully consider your objectives, financial situation, needs and level of experience before entering into any margined transactions with Baxia Markets, and seek independent advice if necessary. Forex and CFDs are highly leveraged products which mean both gains and losses are magnified. You should only trade in these products if you fully understand the risks involved and can afford losses without adversely affecting your lifestyle (including the risk of losing the entirety of your initial investment). You must assess and consider them carefully before making any decision about using our products or services.

Baxia Global Limited is a company registered in Seychelles with registration number: 8426970-1, and is regulated by the Financial Services Authority of Seychelles with License number: SD104.

Baxia Limited is a company registered in The Bahamas with registration number: 177330 B, and is licensed and regulated by The Securities Commission of The Bahamas (SCB), (SIA-F234).

The information on this website is general in nature and doesn’t take into account your personal objectives, financial circumstances, or needs. It is not targeted at the general public of any specific country and is not intended for distribution to residents in any jurisdiction where that distribution would be unlawful or contravene regulatory requirements. Baxia Markets does not offer its services to residents of certain jurisdictions such as USA, Cuba, Sudan/Republic of Sudan, Syria, Iran, Iraq, South Sudan, Venezuela, Libya, Belarus, Afghanistan, Myanmar, Russia, Crimea, Donetsk, Luhansk, Palestine, Yemen, Zimbabwe and North Korea.