- CFDs & Forex Trading | Regulated Online Trading

- About Us

- Trading

- Platforms

- Resources

- Partners

- Research

Search

×

The most popular FX pairs involve major global currencies, gain access to the highest trading volumes and liquidity. Our dependable trading technology and clear fee structures provide highly competitive prices. Below is our pricing or scroll down further to learn more about forex trading.

Important:

1. Positions that are held open for the next trading day (past 00:00 server time) will incur swap charges. The swap charges are calculated on the basis of interest rates difference of two currencies in the instrument. In the MT5 terminal, “swap” is automatically converted into the deposit currency of the account. Swaps values may be adjusted daily based on market conditions. For the latest swap values, please check the specifications in the MT5 terminal.

2. Clients are advised that during the time period from 23:55 to 00:05 server time, spreads may increase and liquidity might decrease due to daily bank rollover. In case of inadequate liquidity and wider than normal spreads, slippage may occur. In addition orders may not be executable during these times.

ZERO Deposit Fees

Choose from multiple (15+) deposit options such as Skrill, Neteller, Visa/Mastercard, Crypto, Local Bank and others with zero fees.

Global Market Access

Trade CFD's (1000+) on a wide range of instruments including Forex, Shares, Commodities, Indices, Precious Metals, Cryptocurrency and Energy.

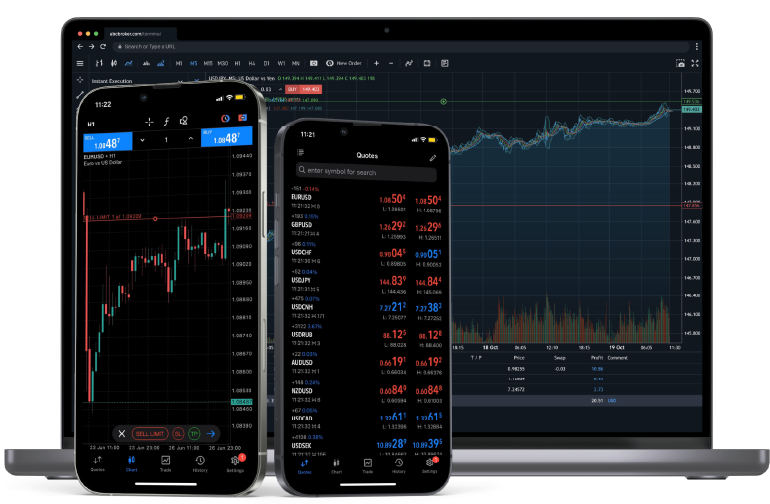

6 Ways to Trade

Trade when you want and anywhere at your convenience with Windows OS, MacOS, iOS, Android, WebTrader and even Linux.

Sub 30ms Latency Trading

Trades are executed through liquidity engines in LD4 and access servers in Asia, Europe and Africa.

Supports Proprietary Trading

Get access up to $2 million in funded trading for qualified profitable traders on MT5.

24/5 Unparalleled Service

Knowledgable and prompt service available on Live Chat, Email, Phone, Whatsapp and Telegram.

Choose from multiple trading options based on your preference of order types, indicators, charting tools, style of trading and operating environment.

Forex trading, short of foreign exchange, is the selling and buying of currencies. Each currency in a pair is represented by a three-letter code. They’re normally formed by two letters that signify the region and the last letter that signifies the name of the currency. For example, AUD stands for the Australian dollar.

› Major pairs - those that are the most frequently traded around the world.

› Minor pairs - those less frequently traded, it does not include the US dollar.

› Cross pairs - those less frequently traded, again do not include the US dollar.

› Exotics - those that are a major currency against one from an emerging economy.

Transactions are completed across the four forex trading hubs around the world. They’re Sydney, Tokyo, London, and New York.

The trading takes place in an over-the-counter (OTC) market and run by networks of banks and brokers, which means that there is no centralized exchange. As there is no centralized location or exchange like for example the New York Stock Exchange (NYSE), it’s possible for you to trade 24 hours a day, 5 days a week.

It’s common for there to be no actual or physical delivery of the currency in retail trading as you trade derivatives of the exchange rate. This makes it easy for almost anyone to participate in forex trading and profit on correctly predicted price movements.

The first currency listed in a forex pair is called the base currency, and the second currency is called the quote currency. The price of a forex pair is how much one unit of the base currency is worth in the quote currency. So if EUR/USD is trading at 1.10041, then one euro is worth 1.10041 dollars.

Ultimately this means if the euro rises against the dollar, then a single euro will be worth more dollars and the pair’s price will increase. If it drops, the pair’s price will decrease.

If you think that the base currency in the pair is likely to strengthen or appreciate against the quote currency, you can buy the pair, otherwise known as going long. If you think it will weaken or depreciate, you can sell the pair, otherwise known as going short.

The difference between the two currencies is the spread. When buy or sell, you are always buying or selling the first currency in the pair. With Baxia Markets you can trade numerous pais in a very friendly way. Whether you are an intraday scalper or long-term investor, modern platforms make it routine to conduct business with forex.

Technical analysis and sentiment analysis are two important methods of market prediction. Technical analysis is the study of past price action to predict future price movements, while sentiment analysis is the study of how investors feel about a particular asset or market. Both methods can be useful for trading currencies, but they have different strengths and weaknesses.

Technical traders tend to focus on shorter-term trends, sometimes even looking at individual candlestick patterns (such as doji or engulfing patterns) as well as trending chart patterns to make decisions about when to buy or sell a currency pair.

The main advantage here is that it gives you more flexibility: if your prediction was wrong, you can get out quickly without losing too much money compared with other strategies, where losses compound over time if you’re wrong early on in your trade cycle.

Sentiment analysis tends to focus more on long-term trends because longer-term data gives us more insight into which way markets will go in the future based on current investor sentiment towards certain assets.

This type of strategy requires greater patience than technical analysis because it takes longer before there’s enough data available for us so we know what direction markets are moving towards (or whether they’re trending up or down).

Most serious traders are familiar with central banks and their roles as monetary authorities in countries around the world. The European Central Bank (ECB) is the central bank for the eurozone, which is the 19 countries that share the euro as their common currency.

The ECB was established in 1998, and its headquarters are in Frankfurt, Germany. Also, the ECB is responsible for monetary policy in the eurozone, but it also supervises banks and has other responsibilities, such as keeping the financial system stable. Ultimately, the ECB’s main objective is to maintain price stability within the eurozone and to preserve the purchasing power of the euro.

Beginner or Advanced? View our full suite of tools and resources to help traders of all levels.

Get started quickly with our free forex trading course for beginners to level up on your trading knowledge.

Evaluate your risk, monitor profit or loss for each trade & estimate trading costs with our full suite of calculators.

Follow high impact news and events for the financial markets including the latest economic data.

Stay up to date with the latest fundamental and technical analysis from the Baxia Markets Analyst team.

Find answers to common questions and topics related to trading with Baxia Markets and the trading platforms.

View our collection of free educational resources to help you become a profitable trader and learn risk management.

More than 1000 CFD instruments to trade on multiple asset classes with one broker.

Precious Metals

Energy

Indices

Commodities

Shares

Crypto CFDs

BAXIA GLOBAL LIMITED

Join the community

Risk Warning: Margin trading involves a high level of risk, and may not be suitable for all investors. You should carefully consider your objectives, financial situation, needs and level of experience before entering into any margined transactions with Baxia Markets, and seek independent advice if necessary. Forex and CFDs are highly leveraged products which mean both gains and losses are magnified. You should only trade in these products if you fully understand the risks involved and can afford losses without adversely affecting your lifestyle (including the risk of losing the entirety of your initial investment). You must assess and consider them carefully before making any decision about using our products or services.

Baxia Global Limited is a company registered in Seychelles with registration number: 8426970-1, and is regulated by the Financial Services Authority of Seychelles with License number: SD104.

Baxia Limited is a company registered in The Bahamas with registration number: 177330 B, and is licensed and regulated by The Securities Commission of The Bahamas (SCB), (SIA-F234).

The information on this website is general in nature and doesn’t take into account your personal objectives, financial circumstances, or needs. It is not targeted at the general public of any specific country and is not intended for distribution to residents in any jurisdiction where that distribution would be unlawful or contravene regulatory requirements. Baxia Markets does not offer its services to residents of certain jurisdictions such as USA, Cuba, Sudan/Republic of Sudan, Syria, Iran, Iraq, South Sudan, Venezuela, Libya, Belarus, Afghanistan, Myanmar, Russia, Crimea, Donetsk, Luhansk, Palestine, Yemen, Zimbabwe and North Korea.