- CFDs & Forex Trading | Regulated Online Trading

- About Us

- Trading

- Platforms

- Resources

- Partners

- Research

Search

×

| Symbol | GBPJPY |

| Name | British Pound vs Japanese Yen |

| Quote Currency | JPY |

| Monday Open | 00:05 |

| Friday Close | 23:59 |

| Session Break | 00:00-00:05 |

| Limit and Stop Level | 0 |

| Execution | Market |

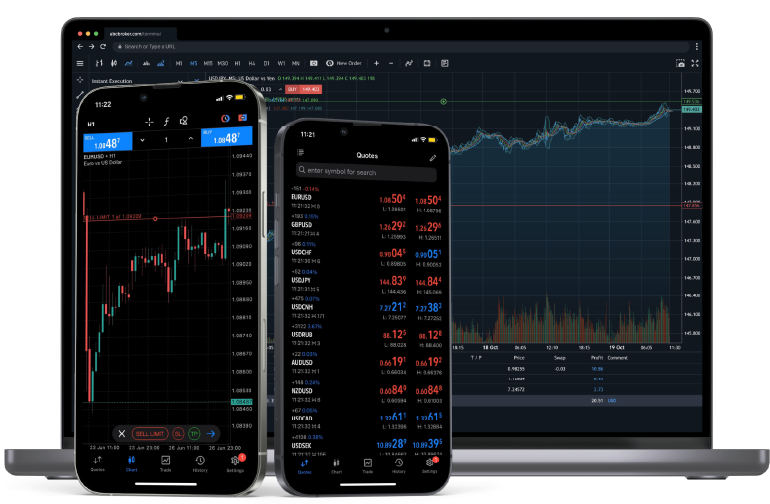

| Trading Platform | MT5, Mobile App, WebTrader |

| Sector | Forex |

ZERO Deposit Fees

Choose from multiple (15+) deposit options such as Skrill, Neteller, Visa/Mastercard, Crypto, Local Bank and others with zero fees.

Global Market Access

Trade CFD's (1000+) on a wide range of instruments including Forex, Shares, Commodities, Indices, Precious Metals, Cryptocurrency and Energy.

6 Ways to Trade

Trade when you want and anywhere at your convenience with Windows OS, MacOS, iOS, Android, WebTrader and even Linux.

Sub 30ms Latency Trading

Trades are executed through liquidity engines in LD4 and access servers in Asia, Europe and Africa.

Supports Proprietary Trading

Get access up to $2 million in funded trading for qualified profitable traders on MT5.

24/5 Unparalleled Service

Knowledgable and prompt service available on Live Chat, Email, Phone, Whatsapp and Telegram.

Choose from multiple trading options based on your preference of order types, indicators, charting tools, style of trading and operating environment.

The GBPJPY currency pair juxtaposes two of the world’s major economies: the UK, with its significant financial services sector, and Japan, known for its strong industrial base and status as a global economic leader. The pair is often seen as a barometer of investor sentiment, reacting swiftly to global economic changes.

UK Economic Indicators:

The strength of the GBP is heavily influenced by the UK’s economic performance, including GDP growth, unemployment rates, inflation figures, and monetary policies set by the Bank of England (BoE).

Japanese Economic Stability and Policies:

Japan's economy, characterized by its technological advancement and export-driven model, significantly impacts the JPY. Decisions by the Bank of Japan (BoJ), particularly on interest rates and economic policy, are crucial determinants.

Interest Rate Differentials:

The GBPJPY pair is sensitive to the interest rate decisions of both the BoE and the BoJ. These decisions can affect the attractiveness of holding either currency, impacting the exchange rate.

Global Risk Sentiment:

The pair is known to be sensitive to changes in global risk appetite. The JPY is often sought as a safe haven in times of uncertainty, while the GBP tends to strengthen in more stable conditions.

Trading the GBPJPY pair in CFDs requires a well-rounded strategy, combining economic analysis, market sentiment, and technical know-how.

Economic Data Monitoring

Keeping track of economic data releases from both the UK and Japan is crucial for anticipating market movements.

Central Bank Policies

Understanding the monetary policies of both the BoE and BoJ is essential, as their decisions can drastically impact the pair.

Technical Analysis

Employing technical analysis, including chart patterns, trend lines, and indicators, helps in predicting market movements and identifying trading opportunities.

Risk Management

Given the pair's potential for high volatility, implementing effective risk management strategies is vital to navigate its rapid price movements successfully.

Start trading GBP/JPY now!

The GBP/JPY pair is influenced by factors such as interest rate differentials between the Bank of England and the Bank of Japan, economic health and political events in the UK and Japan, global market sentiment, and broader geopolitical events, especially those impacting risk sentiment.

Economic indicators like GDP growth, unemployment rates, inflation, and trade balances in both the UK and Japan can significantly impact the GBP/JPY pair. For example, stronger economic performance in the UK relative to Japan might strengthen the GBP against the JPY.

The best times to trade GBP/JPY are typically during the European and Asian trading sessions, when market activity in these regions is highest, and during key economic announcements from both the UK and Japan.

Common strategies for trading GBP/JPY include technical analysis, fundamental analysis, and trend following. The choice of strategy depends on the trader’s risk tolerance, trading style, and market analysis.

Interest rate decisions can have a significant impact on GBP/JPY. For example, if the Bank of England raises interest rates while the Bank of Japan holds or lowers them, it could lead to a strengthening of the GBP against the JPY.

As the JPY is often considered a safe-haven currency, global economic stability or instability can significantly impact GBP/JPY. In times of global financial uncertainty, the JPY might strengthen against the GBP.

Yes, geopolitical events, especially those impacting either the UK or Japan, or global financial markets, can significantly affect GBP/JPY. Such events can alter investor risk appetite and lead to currency volatility.

New traders should understand the economic fundamentals of both the UK and Japan, be aware of the timings of key economic releases, and practice risk management. It’s also recommended to start with a smaller amount when engaging in real-money trading to build experience and understanding of the market dynamics.

Beginner or Advanced? View our full suite of tools and resources to help traders of all levels.

Get started quickly with our free forex trading course for beginners to level up on your trading knowledge.

Evaluate your risk, monitor profit or loss for each trade & estimate trading costs with our full suite of calculators.

Follow high impact news and events for the financial markets including the latest economic data.

Stay up to date with the latest fundamental and technical analysis from the Baxia Markets Analyst team.

Find answers to common questions and topics related to trading with Baxia Markets and the trading platforms.

View our collection of free educational resources to help you become a profitable trader and learn risk management.

More than 1000 CFD instruments to trade on multiple asset classes with one broker.

Forex

Precious Metals

Crypto CFDs

Energy

Indices

Commodities

Shares

BAXIA GLOBAL LIMITED

Join the community

Risk Warning: Margin trading involves a high level of risk, and may not be suitable for all investors. You should carefully consider your objectives, financial situation, needs and level of experience before entering into any margined transactions with Baxia Markets, and seek independent advice if necessary. Forex and CFDs are highly leveraged products which mean both gains and losses are magnified. You should only trade in these products if you fully understand the risks involved and can afford losses without adversely affecting your lifestyle (including the risk of losing the entirety of your initial investment). You must assess and consider them carefully before making any decision about using our products or services.

Baxia Global Limited is a company registered in Seychelles with registration number: 8426970-1, and is regulated by the Financial Services Authority of Seychelles with License number: SD104.

Baxia Limited is a company registered in The Bahamas with registration number: 177330 B, and is licensed and regulated by The Securities Commission of The Bahamas (SCB), (SIA-F234).

The information on this website is general in nature and doesn’t take into account your personal objectives, financial circumstances, or needs. It is not targeted at the general public of any specific country and is not intended for distribution to residents in any jurisdiction where that distribution would be unlawful or contravene regulatory requirements. Baxia Markets does not offer its services to residents of certain jurisdictions such as USA, Cuba, Sudan/Republic of Sudan, Syria, Iran, Iraq, South Sudan, Venezuela, Libya, Belarus, Afghanistan, Myanmar, Russia, Crimea, Donetsk, Luhansk, Palestine, Yemen, Zimbabwe and North Korea.